Call our office today: (201) 503-5353

Perlaw Blog

Perlaw Blog

By Joseph Perlow, Esq.

•

March 11, 2025

An LLC can grind to a halt when members disagree on a decision requiring consent—like a 50/50 split on a majority-consent matter. Without a clear resolution process, these disputes can lead to costly delays or litigation. To avoid this, LLC agreements can include deadlock-breaking mechanisms such as: -Mediation or arbitration. -Engaging a third party with relevant industry expertise. -Buy-sell provisions. Many agreements remain silent on deadlocks, assuming disputes will resolve informally or through litigation. In investment-holding LLCs, where a sponsor holds a majority interest and controls the board, deadlocks are rarely an issue since minority members often lack approval rights. Is your LLC agreement built to handle deadlocks? Let’s discuss.

By Joseph Perlow, Esq.

•

February 24, 2025

As an attorney, I'm often struck by the delicate balance between facilitating a client's entrepreneurial dreams and protecting them from potential risks. On one hand, it's exhilarating to work with innovators and game-changers who are passionate about bringing their vision to life. As their trusted advisor, I want to empower them to take calculated risks and push the boundaries of what's possible. On the other hand, it's my duty to consider the potential exposure and worst-case scenarios that could derail their progress. Walking this tightrope is one of the joys of working with startups and business owners as they grow!

By Joseph Perlow, Esq.

•

February 19, 2025

Imagine pouring water into a multi-tiered fountain. Each level must fill up before the overflow reaches the next. That’s exactly how a distribution waterfall works in investments—profits flow down in a structured order. Here’s the standard three-step waterfall: Return of Capital – Investors get back their initial investment before anyone profits. Preferred Return (Pref) – Investors receive a return (e.g., 8%) before profits are split. Profit Split – Remaining profits are shared, often favoring investors at first, with the sponsor earning a share like 75/25.

By Joseph Perlow, Esq.

•

February 10, 2025

Business contracts aren’t just about money—they define roles, responsibilities, and decision-making authority. When these details are missing, confusion leads to conflict. I recently saw a contract dispute arise because the agreement didn’t specify the roles of the members or the process for making key decisions. When a disagreement came up, there was no clear procedure to resolve it, leading to unnecessary friction and legal costs. A well-drafted contract could have prevented the entire issue. We make sure to clearly define each party’s role and establish a decision-making framework in your contracts. Clarity today avoids disputes tomorrow.

By Joseph Perlow, Esq.

•

January 30, 2025

Here are two of the most common questions I get asked—and the answers you need to know. 1- My tenant is a holdover. Can I evict them? If your tenant is paying rent and is not in material breach of the lease, you cannot evict them unless one of the statutory grounds under N.J.S.A. 2A:18-61.1 applies. New Jersey’s Anti-Eviction Act provides strong tenant protections, meaning you need a valid legal reason—such as non-payment of rent, lease violations, or certain other circumstances—to proceed with an eviction. 2- Can I evict a tenant if I want to live in the property? Yes, but only if the property is a three-family dwelling or less. Under N.J.S.A. 2A:18-61.1(l)(3), a landlord can evict a tenant if they intend to personally occupy the unit. However, the law requires you to provide the tenant with at least two months' written notice before filing for eviction, as stated in N.J.S.A. 2A:18-61.2(b). Have other eviction questions? Drop them in the comments or reach out.

By Joseph Perlow, Esq.

•

January 27, 2025

When bringing on investors, the first and most important concept to understand is equity—the ownership stake that investors receive in exchange for their capital. Equity represents a portion of your business, and giving it up means sharing ownership and, potentially, decision-making authority. In corporations, ownership is structured through stocks. Investors are issued shares of stock, representing their percentage of ownership. Stockholders may have voting rights, receive dividends, or both, depending on the type of stock (e.g., common vs. preferred). In LLCs (Limited Liability Companies), ownership is defined by membership interests, which work similarly to stocks in a corporation. Membership interests outline each investor's ownership percentage and determine their share of profits, losses, and possibly decision-making authority. Equity is more than just ownership; it’s a tool to attract the right investors, align incentives, and fuel growth while ensuring you retain enough control to achieve your long-term vision. Understanding how to structure equity deals can make the difference between a successful partnership and one that limits your business's potential.

By Joseph Perlow, Esq.

•

January 20, 2025

Here are the typical steps involved: Letter of Intent (LOI): Foundation for Negotiations: The LOI lays out the basic terms between the buyer and seller, serving as a precursor to the more binding purchase and sale agreement. It’s typically non-binding but critical for framing the negotiations. Purchase and Sale Agreement (PSA): This agreement outlines terms including the price, earnest money deposit, and specific conditions such as due diligence periods and closing conditions. An important aspect of the PSA is the Deposit. Soft Deposit: Initially, the deposit is kept as a "soft" deposit, which is refundable until the end of the due diligence period. This arrangement allows the buyer to withdraw based on findings during the due diligence without losing their deposit, providing a safeguard against unexpected property issues. Hard Deposit: After the due diligence period, the deposit becomes "hard" and is typically non-refundable. This marks the buyer’s firm commitment to proceed with the purchase, solidifying their financial engagement in the deal. Typically the PSA is prepared by the seller’s counsel, this document includes detailed schedules and exhibits that describe the property, leases, and service agreements, ensuring a transparent transaction. Due Diligence: Property Examination: The buyer inspects all aspects of the property thoroughly to ensure it fits their needs and complies with local laws. This includes reviewing the title report, survey, inspection and environmental reports and rent rolls. Closing: All key closing documents are prepared, negotiated, and reviewed to ensure accuracy and completeness. The closing process includes verifying that all legal requirements are met and that the documents are ready for recording at the local office, finalizing the transaction.

By Joseph Perlow, Esq.

•

January 14, 2025

Arbitration is a popular form of alternative dispute resolution (ADR) that allows parties to resolve conflicts outside of the court system. Instead of a judge or jury, one or more impartial arbitrators decide the outcome, and their decisions are legally binding and enforceable in court. Key points about arbitration: Contractual Basis: Arbitration is only mandatory if agreed upon in a contract. Arbitrators' powers, including the ability to grant specific relief, come from the terms of the agreement. Privacy and Flexibility: Arbitration proceedings are typically private and less formal than court trials. However, rules of evidence are more flexible, which may broaden the scope of documents and testimony considered. Cost and Time: Arbitration is often perceived as faster and more cost-effective than litigation. However, depending on the arbitrator and case, costs can rise if the process is extended. Limited Discovery: Arbitration may restrict the ability to gather extensive evidence, which can be a disadvantage for some parties. No Jury or Appeals: There is no jury, and arbitrators' decisions are final, with limited rights to appeal. This can be beneficial or detrimental, depending on the situation. Key considerations for effective arbitration clauses: 1) Scope of disputes subject to arbitration 2) Arbitration body selection and arbitrator qualifications 3) Location of the proceedings and applicable law 4) Number of arbitrators and relief they can award 5) Allocation of arbitration costs between the parties The Federal Arbitration Act (9 U.S.C. § 1) governs arbitration at the federal level, while many states adopt versions of the Uniform Arbitration Act (UAA) or international arbitration principles such as the UNCITRAL Model Law. Understanding the nuances of arbitration helps ensure dispute resolution provisions are fair, efficient, and tailored to client needs.

By Joseph Perlow, Esq.

•

January 10, 2025

An Operating Agreement serves as a critical framework for defining the governance, ownership, and operational procedures of a limited liability company (LLC). Whether for a single-member or multi-member LLC, a comprehensive agreement helps establish clarity and protect against disputes. Below are the key provisions to consider: Formation and Purpose. Establishes the legal formation, jurisdiction, and primary purpose of the LLC. Management Structure. Defines whether the LLC is managed by members or designated managers, detailing the authority and responsibilities of each. For manager-managed LLCs, identifies appointed managers and their scope of decision-making powers. Ownership and Capital Contributions. Clarifies the ownership interests and initial capital contributions of members and specifies the allocation of profits and losses. Also specifies the terms for additional capital contributions if the company requires further funding, along with potential penalties for non-compliance or failure to contribute. Tax Representation. Appoints the tax representative responsible for handling tax-related matters, including filings and audits. Distributions and Financial Reporting. Outlines the method for profit distributions and the company’s financial reporting practices. Identifies the accounting methods and fiscal year-end. Transfer of Membership Interest. Establishes the rules for transferring ownership interests and the process for admitting new members. Dissolution and Liquidation. Details the events that trigger dissolution and the procedures for liquidating assets and distributing proceeds. Indemnification and Liability Limitation. Provides liability protection for managers and members, subject to limitations for misconduct or gross negligence. A well-drafted Operating Agreement ensures operational stability and minimizes potential conflicts. By addressing governance, financial obligations, and exit strategies, it serves as a crucial document to support the long-term success of the business.

By Joseph Perlow, Esq.

•

January 3, 2025

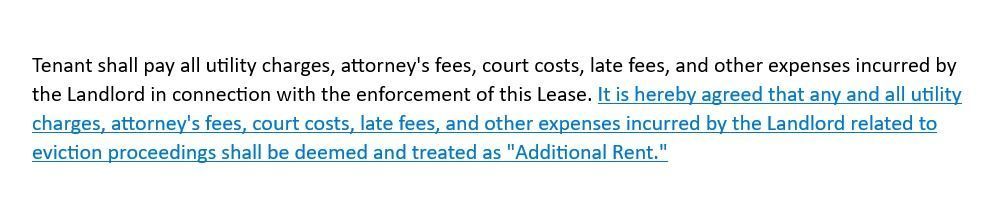

New Jersey courts have long held that parties to a residential lease may treat utility charges, attorney's fees, and other costs related to an eviction as "additional rent" (Sudersan v. Royal, 386 N.J. Super. 246, 252). Without this specific language, you won't be able to evict a tenant for non-payment of these fees in a non-payment of rent action. Protect your rights and ensure your lease is airtight—this small detail can make all the difference.

In New Jersey (and NY), the primary documents for commercial real estate loans generally consist of:

By Joseph Perlow, Esq.

•

January 3, 2025

1) Promissory Note: Outlines the loan amount, interest rate, repayment terms, and conditions of default. 2) Mortgage: Secures the property as collateral, creating a lien. 3) Assignment of Leases and Rents: Allows the lender to collect rents in case of borrower default. 4) Guaranties: Adds security, making guarantors responsible if the borrower defaults. 5) Environmental Protection Agreement: Protects the lender from any future costs or issues related to environmental problems on the property. P.S. My job is to make sure you do not look like that guy!!!!

By Joseph Perlow, Esq.

•

January 3, 2025

Under New Jersey’s Senate Bill 3124, landlords are required to accept full rent payments from tenants within three business days after a lockout due to nonpayment. It’s crucial for landlords to understand that this payment must be accepted if offered, which can effectively stop the eviction process. The law ensures tenants have one final opportunity to make good on overdue rent, even after the lockout has occurred. By complying with this mandate, landlords adhere to their legal obligations and facilitate the resolution of rent disputes, without altering the total amount owed. Understanding this requirement is essential for any landlord navigating evictions.

By Joseph Perlow, Esq.

•

January 3, 2025

Did you know that Landlord-Tenant Court in NJ only awards possession of the property and does not grant monetary judgments? If you're pursuing monetary damages for a tenant’s breach of lease, you’ll need to file a separate civil action for breach of contract. It’s common practice for landlords to file eviction and collection actions simultaneously to regain possession and seek damages. Be sure to take the right legal steps to fully protect your property and financial interests!

By Joseph Perlow, Esq.

•

January 3, 2025

For tenants facing eviction in New Jersey, there is an option to apply for an Order for Orderly Removal, allowing up to 7 additional days to pack belongings and vacate the property. This can be requested ny a Tenant after a judgment for possession and a warrant for removal have been issued. Key things to know: If approved, tenants get extra time but must vacate before the deadline, or their belongings may be considered abandoned, allowing the landlord to dispose of them. Tenants need to notify the landlord or their attorney when applying. If denied, the eviction proceeds as scheduled. This process can also be advantageous for landlords, as they are given a clear timeline and the right to dispose of any remaining belongings after the deadline, helping to avoid complications and speed up the transition to new tenants.

By Joseph Perlow, Esq.

•

December 31, 2024

In New Jersey, once a judgment is entered on the Superior Court’s Civil Judgment and Order Docket, it becomes a statewide lien on all property the debtor owns in the state, including property owned at the time of the judgment and any acquired afterward, pursuant to N.J.S.A. § 2A:26-11 and R. 4:101. The lien is valid for 20 years and can be renewed for an additional 20 years if the creditor files a motion to revive it before the original period expires. In New York, a judgment becomes a lien on all real property the debtor owns in the county where the judgment is docketed, under N.Y. CPLR § 5203. The lien is valid for 10 years and can be renewed if the creditor files a motion to revive it before the original period expires.

By Joseph Perlow, Esq.

•

December 31, 2024

1. Offer 2. Acceptance 3. Consideration (something of value exchanged between parties) 4. Intention to be legally bound However, it's important to note that verbal contracts can be difficult to enforce in court due to the lack of written evidence. Therefore, it's strongly recommended to put agreements in writing to avoid disputes and ensure clarity. I can't tell you how many calls I get each week from clients who made friendly, trust-based deals without anything written down, only to end up in disputes. Do the smart thing: make sure any deal you're working on is properly documented in writing to avoid having to call me later!

By Joseph Perlow, Esq.

•

December 31, 2024

A COJ allows a lender to get a judgment against a borrower without a trial if the borrower defaults. The law defines "concern" broadly to include any profit-driven entity, such as individuals, partnerships, corporations, and more. N.J.S.A. 2A:16-9.1(c). Any contract provision for a COJ that doesn't comply with this law is invalid and unenforceable. N.J.S.A. § 2A:16-9.1(b) Lenders should be careful, as the attorney general can investigate violations of this ban. Violators can face significant penalties: $5,000 for the first offense, $10,000 for the second, and $15,000 for each subsequent offense, plus court costs and attorney fees. N.J.S.A. § 2A:16-9.2

By Joseph Perlow, Esq.

•

December 31, 2024

A lockout happens when the landlord changes locks or padlocks the door without notice, or shuts off utilities to force a tenant out. Both practices are illegal in for residential properties in New Jersey. For commercial tenants, self-help evictions are not strictly forbidden by the legislature. Although case law is limited, New Jersey courts have allowed self-help if the lease explicitly permits it. See, e.g., Liqui-Box Corp. v. Estate of Elkman, 238 N.J. Super. 588 (App. Div. 1990). Do you think there should be difference between Commercial and Residential Tenants? Should self help ever be allowed?

By Joseph Perlow, Esq.

•

December 31, 2024

1. Staying after the lease ends 2. Not paying rent 3. Engaging in disruptive behavior 4. Damaging the property 5. Repeatedly breaking lease rules 6. Violating lease terms where the landlord has reentry rights N.J.S.A. 2A:18-53 A commercial landlord must carefully include any necessary provisions in the lease to avoid being limited to these reasons.

By Joseph Perlow, Esq.

•

December 31, 2024

By design, an LLC creates a legal separation between the company and its owners, ensuring that personal finances remain shielded. However, this protection is not guaranteed—it requires the LLC to be properly structured and operated with adherence to corporate formalities. This is where the doctrine of piercing the corporate veil comes into play. If a party can demonstrate that the LLC was misused—whether as a vehicle for personal dealings or fraudulent activity—they may persuade a court to hold the individual owners personally liable. Importantly, meeting this standard is no simple task; it requires concrete evidence, not speculation or conjecture. I recently defended a client whose LLC was accused of being a mere shell company. The other side claimed that the LLC was undercapitalized and lacked proper insurance and management, which they argued justified holding the individual owner personally responsible. We showed that nothing was backed by actual evidence. After reviewing the facts and arguments, the court ruled in our favor, protecting my client’s personal assets. It is important here to recognize the strength of LLC protections when entities are properly maintained. For business owners, it underscores the importance of diligent corporate governance to preserve this shield.

By Joseph Perlow, Esq.

•

December 31, 2024

When navigating commercial financing, it's essential to distinguish between a loan term sheet and a loan commitment: Loan Term Sheet: A non-binding outline of material terms and conditions, serving as a negotiation guide. While detailed, it doesn't obligate either party but typically aligns both sides on key terms. Loan Commitment: A binding agreement where the lender commits to fund the loan, subject to specific approvals (e.g., title review, tenant estoppels, zoning compliance). It often requires a non-refundable commitment fee and expense deposits. The choice between the two depends on factors like market conditions, the lender's internal processes, property vacancy levels, and tenant creditworthiness. Borrowers may prefer a term sheet to reduce upfront risk, while a commitment provides certainty in volatile markets. It's a strategic decision that lenders, borrowers, and their counsel must carefully evaluate.

By Joseph Perlow, Esq.

•

December 31, 2024

No, an LLC can only have one operating agreement at a time. An operating agreement is a legal document that defines the ownership structure, management rules, and operational procedures of an LLC. It acts as the company's rulebook, outlining how decisions are made, profits are shared, and disputes are resolved. Having multiple operating agreements would lead to conflicts and confusion. Any updates or changes should be made through amendments to the existing agreement to ensure consistency and clarity.

By Joseph Perlow, Esq.

•

December 31, 2024

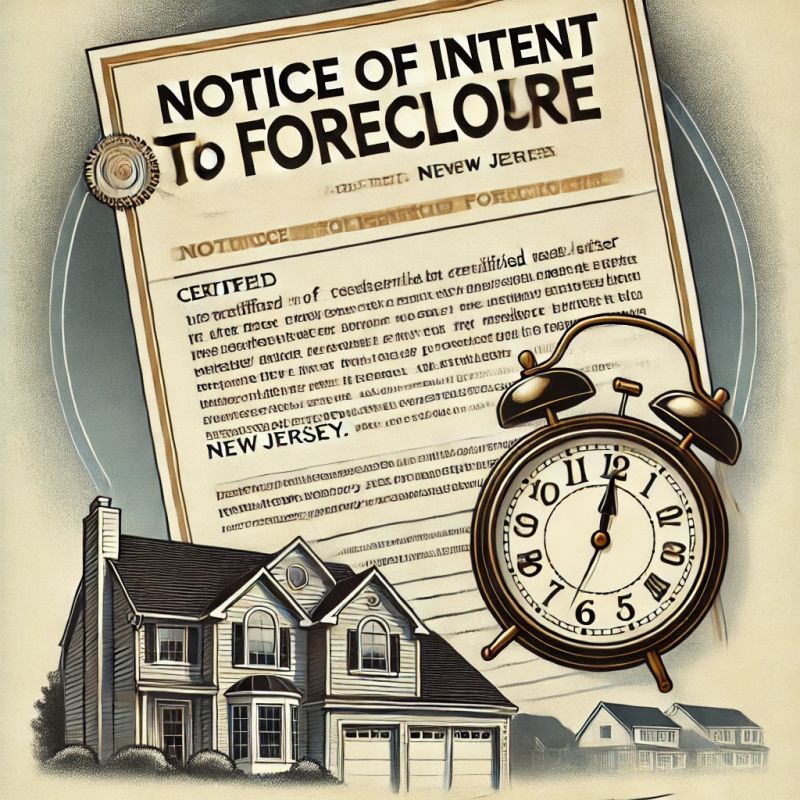

In New Jersey residential foreclosures, lenders must ensure that a valid Notice of Intent to Foreclose (NOI) is sent to all parties obligated on the debt. The NOI must be mailed via certified mail (return receipt requested) and regular mail to both the property address and the borrower’s last known mailing address if different. It must include specific information required under N.J. Stat. § 2A:50-56(c) and provide a 30-day cure period before the complaint can be filed. Importantly, the NOI must be dated within 180 days of the complaint filing date, creating a five-month window after the cure period expires for filing. If this window closes and the NOI goes stale, a new notice must be sent, restarting the 30-day cure period. Strict adherence to these requirements is essential for lenders to proceed with foreclosure actions efficiently and in compliance with NJ law.

By Joseph Perlow, Esq.

•

December 9, 2024

1) File a Verified Complaint and Summons: The landlord files a complaint and summons with the court. All interested parties are notified of the proceedings. 2) Trial Date and Default: A trial date is typically set within 5 days. The Date is usually somewhere between 30 and 60 days from the date of the complaint filing. If either party fails to appear, the court may enter a default judgment. If the tenant defaults, the court will file a judgment of possession in favor of the landlord. 3) Mandatory Settlement Discussions: If both parties appear at the trial, mandatory settlement discussions are held. If a settlement is agreed to, the judge will file the settlement. 4) Entry of Judgment for Possession: There are generally 4 types of judgments: - Default Judgment: Granted when the tenant fails to appear in court or respond to the eviction complaint. The landlord submits certifications, and the court issues the judgment. - Consent Judgment: Issued when the landlord and tenant agree to a settlement,. The judgment is based on the settlement terms. - Judgment After Breach of Settlement: Issued if the tenant breaches a settlement agreement. The landlord files the breach with the court, and the court will grant a judgment for possession upon showing the tenant's non-compliance with the agreement. - Judgment After Trial: Issued if the case goes to trial and the court finds in favor of the landlord. The landlord must prove the tenant's breach of the lease. Issuance of Warrant of Removal: 5) Three business days after the judgment for possession, the landlord may request the court to issue a warrant of removal. Once requested a judge will file the warrant of removal. 6) Service of the Warrant of Removal. The warrant of removal is served by a Special Civil Part Officer on the tenant by delivering or posting the warrant of removal on the door of the rental property. 7) Execution of the Warrant of Removal/ Eviction. Three business days after the warrant of removal is served, a landlord may request that the Special Civil Part Officer return to the residential rental property a second time to execute the warrant of removal by requiring the tenant to vacate the premises and permitting the landlord to change the locks. This is when the eviction (lockout) is completed.

By Joseph Perlow, Esq.

•

December 9, 2024

When filing an eviction, consider drafting a settlement agreement to present BEFORE trial. This approach can save you time and money on legal fees! In NJ, mandatory settlement talks are required before trial, so why not get ahead of the game? By presenting an agreement beforehand, you can: - Avoid costly trial fees - Encourage a mutually beneficial resolution - Streamline the process Have your attorney draft a comprehensive agreement and present it to your tenant before trial. This proactive approach can lead to a more efficient and cost-effective resolution.

By Joseph Perlow, Esq.

•

December 9, 2024

In New Jersey, landlords must follow specific procedures to dispose of personal property left behind by tenants, as outlined in N.J.S.A. 2A:18-72 through 2A:18-84. Here’s what you need to know: Give Notice: Before disposing of any property, landlords must provide written notice to the tenant by certified mail, return receipt requested, or by receipted first-class mail addressed to the tenant at his or her last known address or addresses. The landlord must mark the envelope “Please Forward”. There are very specific requirements for the content of the notice. 2A:18-74. Storage Requirements: If the tenant doesn’t retrieve their property within the specified time, the landlord must store it with reasonable care. This includes non-perishable items, while perishable goods or pets may be handled differently. Disposal Options: After the notice period, landlords may sell, destroy, or otherwise dispose of the property, depending on its value. For valuable items, a public or private sale may be held, while items with little value may be discarded. Cost Recovery: Landlords are entitled to reasonable storage and sale costs, which can be deducted from the sale proceeds. Any remaining funds must be returned to the tenant, or if the tenant cannot be located, the funds must be deposited with the Superior Court. Tenant's Rights: If a landlord fails to comply with these rules, tenants can recover up to twice the damages caused by improper disposal. For landlords, following these steps ensures compliance with New Jersey law and helps avoid costly legal battles. If you're navigating this process, it's essential to do it right. Stay informed and compliant!

By Joseph Perlow, Esq.

•

December 9, 2024

As a landlord, it's crucial to know the legal grounds for evicting tenants who cause disturbances or damage to your property. Here are two key reasons where eviction may be pursued: Disorderly Conduct: If a tenant continues to engage in disorderly behavior after receiving a written notice, and this behavior disrupts the peace of others, landlords can file for eviction. However, a Notice to Quit must be served at least 3 days before taking legal action. Damage to Property: Eviction is also possible if the tenant has caused significant damage to the property—whether intentional or due to gross negligence. Similarly, a Notice to Quit is required 3 days before filing the eviction suit. Being proactive and following proper procedures can protect your rights as a landlord and help maintain a peaceful living environment for all tenants.

By Joseph Perlow, Esq.

•

December 9, 2024

In New Jersey, what is commonly known as a mechanic's lien elsewhere is referred to as a construction lien. This legal claim allows contractors, subcontractors, and suppliers who have not been paid for their work or materials to secure their right to payment by placing a claim on the improved property. The New Jersey Construction Lien Law (N.J.S.A. 2A:44A) provides a structured process with specific steps and deadlines to make a lien valid and enforceable. A construction lien protects those who enhance a property by ensuring they have a formal mechanism to recover unpaid balances directly from the property, preventing its sale or refinancing until payment obligations are satisfied. For those involved in New Jersey construction projects, understanding and following the legal procedures for construction liens is critical to protecting your rights.

By Joseph Perlow, Esq.

•

December 9, 2024

Almost all commercial loans are structured with the borrower as an entity—like an LLC or corporation—rather than an individual. This setup provides limited liability protection for the principals, shielding personal assets while focusing liability on the entity itself. Within this framework, borrowers encounter various loan structures: Full Recourse Loans: Borrowing entity and its guarantors are fully liable for repayment, allowing lenders to pursue other assets if the property doesn’t cover the debt. Nonrecourse Loans: Recovery is limited to the proceeds of the mortgaged property after foreclosure, insulating principals from personal liability. Nonrecourse Carve-Out Guaranties (often nicknamed "Bad Boy Carve-Outs"): In specific scenarios like fraud, misrepresentation, or misappropriation of funds, certain borrower principals may face personal liability. These provisions hold borrowers accountable for "bad acts" that jeopardize the lender's position while maintaining the general protection of nonrecourse terms. This entity-based structure often reduces personal risk but adds complexity to loan negotiations, especially around default provisions and carve-outs. Borrowers and their advisors should carefully evaluate these terms to ensure alignment with their financial and operational goals.

By Joseph Perlow, Esq.

•

December 4, 2024

The Conveyance Clause is a critical component of mortgage agreements. This clause outlines the legal mechanism by which the property owner (grantor) provides the lender (beneficiary) with a lien on real property as collateral for a loan. A typical clause reads: "GRANTOR HEREBY irrevocably mortgages, grants, conveys, and assigns to and for Beneficiary, all that property in the County of [name of county], State of New Jersey described as:..." Mortgages in the United States generally follow one of two legal theories: Title Theory In title theory states, the lender (beneficiary) holds legal title to the property as security for the loan. The property owner (grantor) retains possession but transfers the title to the lender until the loan is fully repaid. If the grantor defaults, the lender has the authority to foreclose on the property without further legal action, as they already hold title. Lien Theory In lien theory states, the property owner retains both legal and equitable title to the property, while the lender holds a lien as security for repayment. The lien gives the lender a legal interest in the property but not ownership. If the grantor defaults, the lender must initiate foreclosure proceedings to enforce the lien and recover the debt. New Jersey adheres to the lien theory of mortgage law. This means that while the property owner remains the legal owner, the lender's lien acts as security for the loan. If the borrower defaults, the lender must go through a foreclosure process to sell the property and recover the unpaid balance. Understanding New Jersey’s lien theory is crucial for anyone involved in real estate financing, as it affects the rights and responsibilities of both borrowers and lenders.

By Joseph Perlow, Esq.

•

October 14, 2024

Usury is when someone lends money to another person or entity and charges an excessively high interest rate on the loan. These high-interest rates are considered unfair or illegal because they take advantage of the borrower, making it difficult for them to repay the loan. Many laws are in place to limit how much interest can be charged to protect borrowers from being exploited by lenders. If a lender charges interest above these legal limits, it is considered usury. In New Jersey, if a loan agreement is made verbally, charging more than 6% interest per year is considered civil usury. If there's a written agreement specifying the interest rate, charging more than 16% per year is civil usury. According to N.J.S.A. § 31:1-1, if a lender charges more than the legal interest rate, they lose the right to collect any interest and can only recover the principal amount of the loan. Additionally, if the borrower has already paid interest above the legal rate, that excess amount is deducted from the principal they owe (N.J.S.A. § 31:1-3). In New Jersey, it's a *criminal* offense to charge or collect interest at excessively high rates. Specifically, charging more than 30% per year in interest from an individual is considered criminal usury (N.J.S.A. § 2C:21-19). For businesses like corporations, LLCs, or LLPs, charging more than 50% per year is also criminal usury (N.J.S.A. § 2C:21-19). So what's the difference between civil and criminal usury? Civil usury involves charging illegally high interest rates with penalties like losing the right to collect interest, while criminal usury involves charging extremely high rates that can lead to criminal charges.

Perlow Law LLC

Protecting & Maximizing

Clients' Interests & Potential

Contact Us

NJ OFFICE:

4 Brighton Road, Suite 204

Clifton, NJ 07012